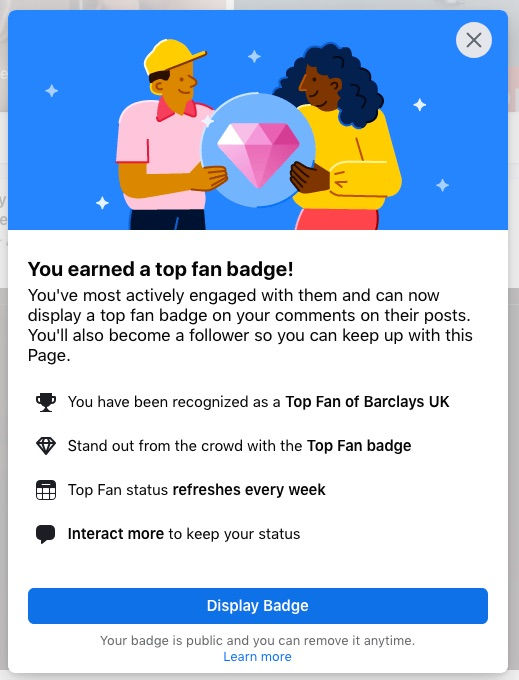

Facebook recognises my special status

- Carl Wackan

- Aug 14, 2022

- 5 min read

So over the past few weeks, and more importantly after being invited by Barclays to engage with their online team... With a view negotiate and find some form of resolution, we've reach this new highlight... Facebook thinks I'm Barclays top fan, let's not have the truth get in the way of a wholey unlikley story.

You may well ask, what's happened in our little social interludes. Did any progress happen, is victory on the horizon for the victim..? As it's simple to agree there is a victm in all this, we've been ignored by Barclays. Some would say bullied, lied to, forced to make decision by a fanancial institutions with tens of thousands of employees and obligations to treat clients fairly. However in our case this could not be further from the truth. In the 10+ years we've seen it all, and it's all ugly, Barclays simply does not care for it's clients, has no regard for it's obligations and tries to use brute force to prove that "might is right!"

As a disabled person, I've been astounded how I've been treated. This incorrect behaviour has extended from Barclays right across my family. They've had a pop at my wife, which might not seem a big deal however. I've made a promise to my wife's parents, infront of witnessess that my actions would always be geared to protect, love, honour and put above all others. Which simply leads us to where do they think it's is going to end?

It's broight into stark focus when, as a sign of care and concern Barclays makes a malicious allegation against me. Which ends with the police making an appearance at my front door.... All of this within the last few weeks

As you can guess the Police didn't take too well to having their time wasted, hwoever it did bring out a little gem of information. "Barclays alledges I'm a danger to the House!" Again you might wonder what that means. Put simply we're playing for around 1.2-1.7million pounds, which barclays would like to sieze as the prize in this little game of stare down.

While I maintain the mortage was predatory lending by the bank, no due dilligence was used to establish facts I have freely provided, facts which come from my Barclays accounts. So it's reptty simple Barclays have covered up, what they did to us, when they closed my accounts. They obfuscated the facts the mortgage was predatory and so the contract we entered into is more than likley false and void. It's taken 10 years to get to this...

I on the other hand have always mantianed my position, have tried to negotiate and have taken the whole not getting any form of engagement from Barclays. That they either agreed with me. Or we'd have a full on show down. I went on and declared that if I can't have it, I'll see to they don't get it. This is brinkmanship and it puts a line in the sand.

Which raises the question The Ombudsman recommended and instructed Barclays and I to negotiate. Which I have tried, with both reasoning and by way of offers made. However it appears you cna reason with unreasonable people. Worse if you have no response at all to any offers made how can you find a resolution. Please bear in mind this was after the Ombudsman found in my favour that Barclays Bank had used methods of Harrassement against me and members of my family.

Had caused unreasonable levels of hardship, broken it's own rules, used coercion, threats, lied to get me to commit fraud or write myself into a contract that I could not support as we had no income. After the bank closed all my acocunts and then seemed genuinely shocked that my reply was that the bank could go and fuck itself.

So where do we go from here, well I've made yet another offer to resolve this, barcllays has now broken off contact and has not replied to any messages on the twitter feed to which they invited me. For the sole purpose to apparently discuss the issue...

Is there a simple right and wrong? It's hard to say, I maintain we're the victim. I told the bank all the truth, I submitted all the papers and they had a duty to either inform us of the rules. By which they have to answer to the FCA (financial conduct authority) failure by them to do this means on simple thing there's no contract, failure to engage with me leads me to believe I'm right. If they geniunely thought they could get away with this, they'd have sent that fat old prat around again who threatended me before.

What's the goal of this blog, it's simple if you have a financial product, and the lending party failed to inform you of the rules under which this product was provided, sold or taken out, They are saddled with the liability and blame and you can't be held to a contract that favours one side over the other. Contracts are made mostly in three parts, what is discussed, how the contract is entered into and the paperwork. Barclays claims that only the paper contract is what counts. Which they failed to supply and avoided providing for 10+ years. Based on the balance of probability they know exactly what the outcome is. I've paid real money into a mortgage, that was ether... imaginary make believe numbers made up to favour the bank and at every step protect them.

For the last 10 years the bank wishes and has tried to take bricks and mortar I've bought and paid for. Which Barclays has obstructed me in doing by closing my accounts. I presume they where fully aware of these actions, it was diliberate and I'm informed I'm not the only person in this position. Barclays simply wants to keep the money I've paid let's say 500K and house becomes a bonus so to speak. So all up we're at just over 2million pounds. While Barclays activley tressspassed on my compensation claim which I'm told was worth a further 2million pounds and I had to cover all the legal bills which came to around 500K. That means barclays thinks that screwing me and ordinary nobody, over for let's say clsoe to 5 million is a good day at the office.... Well if they are doing that to me, what are they doing to the high net worth clients who's money they apparently look after...?

I have to object to their claims that everything is being done to help me.... Which it clearly isn't and I can't see how this is fair based on my evidence, Evidence Barclays claims does not exist or that it should be ignored as it's old paperpwork But we have been at this for nearly 12 years, and it was current 12 years ago and like a fine wine as aged really well..... My evidence just goes against Barclays narrative and based on the balance of probability further suggests I have a point they should answer.

Closure, that's a great question, how do we reach that moment when we can leave each other alone. I suggested we wind back the back the clock to the moment the mortgage change took place, we take every penny I've paid to Barclays and this is removed from the original sum. It's fair and elegant, even Barclays own employees have mentioned this is a sensible option. That raises the question why can't we do that, well if Barclays chooses not to negotiate, or engage with me... they're stuck and till they see that as the stopping point then they remain stuck with me. Taking little chunks out of them at every turn till someone gets bored and I don't have anything better to do so I very much doubt it's going to be me.

If Barclays chooses to involved solicitors, again this would be seen as acting in bad faith and not how the Ombudsman wanted it to be conducted. If Barclays comes to the table and accepts my offer, everything stops so the choice is very much theirs to do the right thing.

Comments